Get all the insurance quotes you need in 30 minutes or less.

It really can be that easy. Basoco Agency advisors leverage the latest technology to provide recommendations for insurance coverage products and carriers that best fit your needs.

Have you ever wondered...?

Will social security be there when I need it?

The maximum monthly Social Security Check in 2024 is $3,822.

Click here to go to the Social Security Administration Website and get a benefits estimate.

Ask yourself: Can I live on that even if it is there? What will inflation look like in my retirement years?

Here’s the National Debt Clock Website

You will need more. |

That's where life insurance comes in.

Learn more about the options you’ll have when you connect with one of our dedicated insurance advisors. We’ll get to know you and answer any questions you have as we guide you through the process.

You don’t have to pay into insurance that only offers benefits when you die. Living benefits plans cover you in the event of major health issues like heart attack, stroke, and other debilitating and potentially catastrophic events.

Wouldn’t it be nice to get your premiums back at the end of the term? Many of our carriers offer this option in both term, whole life and mortgage protection options. Here’s a quick overview video.

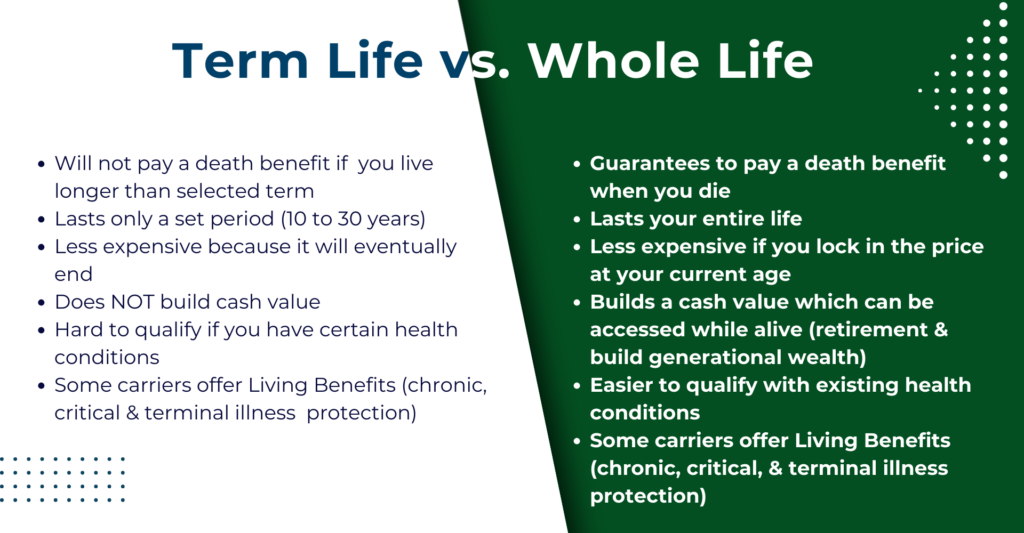

The most affordable type of life insurance, term policies offer coverage for a specific period of time. Many policyholders choose coverage for 10 to 30 years, depending on age and health considerations. These plans may be purchased without a physical exam requirement. Ask your Basoco Agency advisor if a term life policy is right for you.

IUL plans offer adjustable benefits and cash value benefits, in the form of a permanent policy that you can use as an infinite bank. When you need cash for big expenses, weddings, college, retirement, or any need, your Indexed Universal Life cash balance allows you to borrow against your policy.

For businesses who rely on certain employees for their success, Key Person Insurance provides continuity after the death of an owner or employee. This type of plan pays the death benefit to the business if the insured key person passes away.

Indexed Annuities provide guaranteed protection against loss while benefiting from growth. They can provide a lifetime income that you and your spouse can’t outlive and can be drawn upon in the event of critical, chronic, or terminal illness to fight while you’re alive without draining your savings. Plus, they leave a death benefit to anyone or organization that you choose. These can be a good option for old 401-Ks and other windfalls in preparation for your desired retirement.

Ensure that you have the income you need in retirement with a policy created to give you flexibility and a tax-free retirement income. Basoco Agency advisors may recommend one or more insurance products designed to give you that freedom and financial security during your retirement years.

(PMI) Private Mortgage Insurance pays the mortgage company in the event of your death, but Mortgage Protection insurance pays off your mortgage. In the event of your death, your family can stay in the family home without worrying about mortgage payments. The tax-free cash infusion can also be used to pay off any debt you choose.

This type of whole life insurance policy pays the immediate costs after death: funeral, burial, court costs, and medical bills. Relieve your family of the worry and burden of paying for your final expenses with a plan that lets them grieve without added financial stress.

Start your insurance quotes with a no-obligation assessment.

Let’s work together to find the right coverage for you, your family, your business, and your future. There’s much more to insurance than term vs. whole life; you deserve insurance policies that offer more flexibility and options for the life you’re living now. To help you, we need to listen deeply. Let your Basoco Agency advisor collect the right insurance quotes for you to choose from.